In order for the balance sheet to stability, whole belongings on one side should equal whole liabilities plus shareholders’ fairness on the other side. Lastly, annual monetary statements are essential for tax reporting and tax return filing. Documenting earnings, expenses, belongings, and liabilities in the statements simplifies completing the paperwork required by tax authorities each year.

These ratios by themselves not often give exterior users and determination makers enough info to evaluate whether or not or not a company is fiscally sound, however. Traders and creditors usually compare different companies’ ratios to develop an industry normal or benchmark to judge firm performance. The objective of those stories is to offer helpful financial info to users outdoors of the corporate. In essence, these stories full the elemental function of financial accounting by providing https://www.kelleysbookkeeping.com/ data that is helpful within the financial decision-making course of.

Calculating Whole Equity

What this means is that every one asset accounts might be listed first, and the whole of those accounts might be equal to the next two classes, which might be listed next. In this example, we are in a position to see that ABC Limited Liability Company’s complete property increased from $300,000 in 2021 to $370,000 in 2022. If the corporation goes into liquidation, then the holders of this inventory have less priority to get funds than others preferred shareholders or lenders. Widespread Inventory or Strange shares are the same, and this class of shares normally has voting right. The ordinary share is recorded at par value in the stability sheet under fairness sections.

- With a structured view of your earnings and expenses, monetary statements let you build realistic budgets and forecasts based on precise efficiency, not guesswork.

- It sometimes consists of an income statement, balance sheet, assertion of money flows, and statement of adjustments in fairness.

- The objective of those stories is to offer helpful monetary information to customers exterior of the corporate.

Be Taught what consolidated financial statements are, tips on how to streamline the method and the advantages of automating your financial consolidation. Study the way to do a stability sheet with step-by-step instructions, examples, and analysis tips to perceive your business’s financial health. Understand the distinction between a stability sheet and an income statement, when to use every, and how Rippling simplifies financial administration. The format is dependent upon the kind of financial statement and its supposed use.

Quantitative Evaluation

The note offers necessary details like maturity, rate of interest, and other phrases of debt. The info is essential to evaluate the capital construction and carry out credit score evaluation if new debt must be issued. The steadiness sheet is often considered an important of the three statements, as it may be used to determine the health and sturdiness of a business.

How Stakeholders Use The Statement Of Economic Position

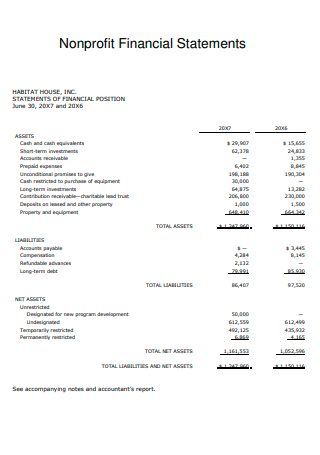

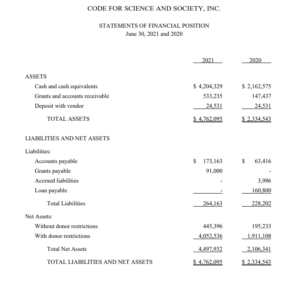

Donor-restricted (true) endowment funds have to be statements of financial position held in perpetuity and the university could only spend a portion (as determined by the Board of Trustees) of the earnings from the investments. The university has also made strategic decisions to take a position further funds in its endowment to provide long-term monetary stability. The assertion of monetary position supplies a clear image of a business’s overall monetary well being and performance.

#4 – Long Term Liabilities

While reading the current assets section of the stability sheet, it is necessary to examine for asset overstatement, such as large accounts receivable because of an improper allowance for doubtful accounts. Further high quality of property cannot be immediately determined using the stability sheet alone. The property part of the stability sheet accommodates the asset accounts of the enterprise. They are accounts that lead to the technology of future money inflows like accounts receivable or are used within the enterprise like property, plant, and gear (PP&E).